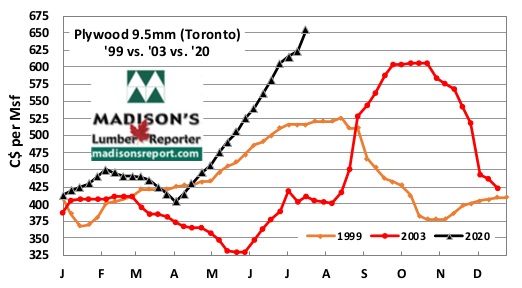

Lesprom- Canadian Softwood Plywood 3/8” or 9.5mm FOB Toronto prices last week were C$636 msf, a decrease of -$18, or -3%, from the previous week. Last week’s price is +$37, or +6%, more than it was one month ago, according to Madison’s Lumber Reporter.

Compared to one year ago, this price is up +$148, or +30%. Put another way, last week’s price is up +$180, or +40%, relative to the 1-year rolling average price of C$456 msf and is up +$170, or +37%, relative to the 2-year rolling average price of C$466 msf.

In dimension lumber meanwhile, sales were a bit slower last week according to Western S-P-F purveyors in the US, yet prices continued to rise and availability of commodities remained extremely limited. Inventories at all levels were strapped and contractors scrambled to find enough material to keep jobsites going. Producers reported sawmill order files into the latter half of August. Secondary suppliers continued to scare up deals above print, as many desperate customers were willing to pay anything to ensure quicker shipment than sawmill-direct.

Even as many buyers stepped away from the market to digest incoming stock last week, Canadian suppliers of Western S-P-F lumber remained extremely busy. Monday and Tuesday were especially highlighted as slightly slower days last week, but the context in which sawmills described that relative drop helped. “We sold out in minutes instead of seconds,” they explained. Sawmill order files underscored the strength of the market, extending into the week of August 24th.

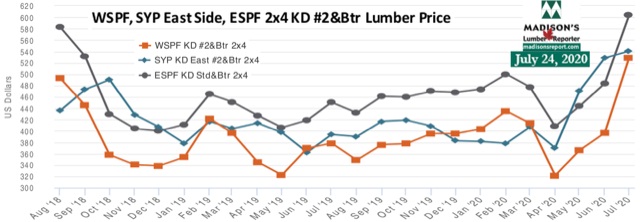

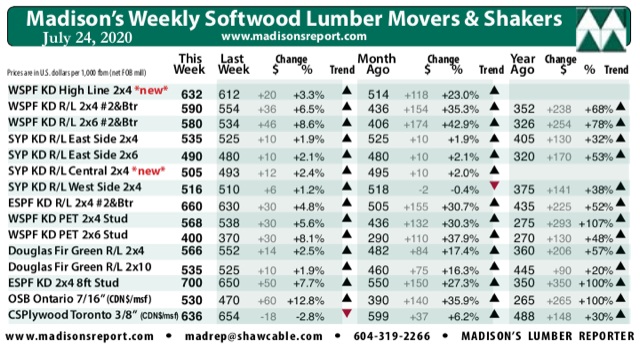

For the week ending July 24, 2020, prices of standard construction framing dimension softwood lumber items increased yet further. Benchmark softwood lumber item Western S-P-F 2×4 #2&Btr KD rose once again, up by another +36, or +7%, to US$590 mfbm, from US$554 the previous week. The price for this lumber commodity was up +$154, or +35%, from one month ago. Compared to the same week in 2019 this price is up +$238, or +68%.

Eastern S-P-F lumber dealers were again agog at the unrelenting demand from customers in the East. So little material was available – and prices so insanely high – that some buyers were switching from Spruce to Douglas-fir to save a few bucks. All species remained in exceptionally tight supply as inventories-on-hand were decimated at all levels.

Last week’s Western S-P-F 2×4 price did surpass the recent-record high of 2018, climbing another +$197, or +50%, relative to the 1-year rolling average price of US$393 mfbm and up +$201, or +52%, compare to the 2-year rolling average prices of US$389 mfbm.

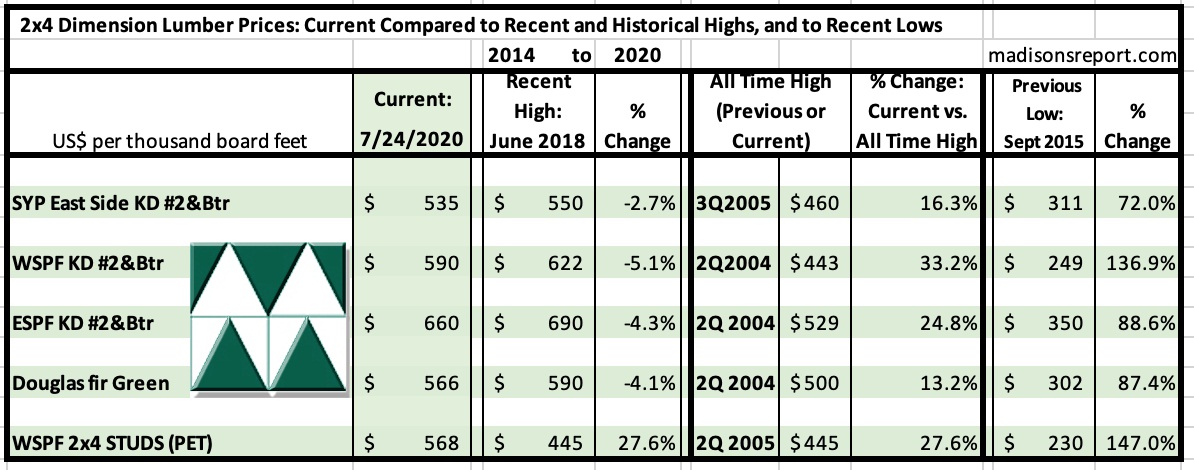

The below table is a comparison of recent highs, in June 2018, and current July 2020 benchmark dimension softwood lumber 2×4 prices compared to historical highs of 2004/05 and compared to recent lows of September 2015: