- Regardless of the results of COVID-19, Vietnam’s GDP grew at 2.91% and recorded optimistic development in key areas of business exercise.

- Within the first 11 months of 2020, international traders invested US$17 billion in Vietnam with a good portion of those tasks focused on manufacturing, processing, actual property, and electrical energy manufacturing and distribution.

- Effectivity positive factors and client demand had been key parts of Vietnam’s funding attractiveness. Going ahead, these may very well be supplemented by an increasing digital economic system in addition to Vietnam’s participation in a number of regional and international commerce agreements.

Regardless of the detrimental socio-economic penalties of COVID-19, Vietnam is likely one of the few international locations that recorded optimistic financial development in 2020. As per the General Statistics Office (GSO) Vietnam’s GDP elevated by 2.91 % in 2020. This displays two key components: the relative success in containing the well being and enterprise dangers of the pandemic, and the flexibility of the nation to maintain investor confidence excessive.

As per the GSO, industrial activity in 2020 expanded by 3.3 %. Sub-sectors akin to development, utilities, and manufacturing all recorded optimistic development charges. Then again, companies had been negatively impacted by mobility constraints and decreased spending. As an example, the transportation and hospitality sector contracted by 1.8 % and 14.6 % respectively. Due to this fact, in 2020 the financial development of two.91 % was asymmetrically distributed.

Other than uneven positive factors, one other key element of Vietnam’s 2020 financial development has been the position of international capital within the nation. FDI undertaking worth within the first 11 months of the yr was estimated at US$17 billion, bringing the full gathered FDI inventory worth to US$382 billion throughout 32,915 tasks.

All year long, the exercise of international traders mirrored three key tendencies in 2020 which can be more likely to carry ahead into 2021:

1. Commerce-intensity of FDI

Throughout the worldwide economic system, the COVID-19 pandemic negatively affected commerce by way of low demand, and supply chain disruptions. Regardless of these results, Vietnam’s export and import turnover (items commerce) was US$543 billion, a 5 % annual rise. Exports had been significantly vital on this enhance, with an estimated export worth of US$281 billion.

Alongside this enhance in export-import exercise, the trade intensity of FDI additionally elevated for the primary time in ten years. International corporations performed a big position within the export and import of products and companies. In items commerce, as an illustration, the FDI sector accounted for 72 % of complete export turnover and 63 % of import turnover. This more than likely displays FDI choice for trade-intensive sectors akin to manufacturing and crude oil and optimistic results from quite a few commerce agreements signed not too long ago together with the EU-Vietnam free trade agreement (EVFTA) and the UK – Vietnam FTA.

2. Effectivity positive factors and client demand: Pillars of Vietnam’s funding attractiveness

Because the desk beneath exhibits, the manufacturing and processing sector accounts for 48 % of complete registered funding capital within the nation. This place is adopted by US$60 billion in actual property, US$28.7 billion in electrical energy manufacturing and distribution, and US$ 12 billion in lodging and meals companies. Different notable FDI sectors embrace development, wholesale, transport, mining, schooling, and data know-how.

This big selection of sectors signifies a variety of attainable sources of Vietnam’s FDI competitiveness. The domination of the manufacturing and processing sector displays the effectivity positive factors supplied by Vietnam to international corporations. An rising variety of corporations have shifted their manufacturing operations to Vietnam or have adopted a China + 1 model. Lately, the federal government has targeted funding attraction in supporting industries in some areas, given the significance of provide chain effectivity in attracting manufacturing sector FDI. If this development is to proceed, sources of inefficiency akin to infrastructure bottlenecks, and land availability will must be addressed.

Moreover, a lot of sectors within the aforementioned record are consumer-facing. Examples embrace meals companies, retail, transportation, and schooling. Consumer demand growth is mirrored within the 3.2 % annual enhance within the client value index in 2020. With a inhabitants of over 96 million, the vast majority of whom are below the age of 35, it’s anticipated that the middle-class in Vietnam might double by 2026. This means future alternatives for international traders in consumer-facing sectors.

3. Regional sources of funding

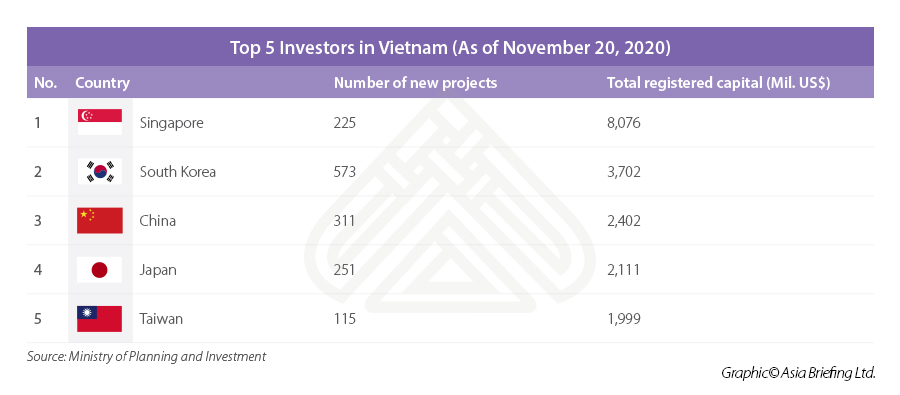

As of November 2020, there have been 109 international locations and territories with investments in Vietnam. Singaporean corporations have invested US$8 billion within the nation, the biggest, beating South Korea from final yr. South Korean corporations got here second (invested capital US$3.7 billion), adopted by China (funding capital US$ 2.4 billion). As well as, a number of corporations from Japan, Thailand, and Taiwan are additionally lively within the nation.

In recent times, Asian international locations have risen to signify a bulk of Vietnam’s FDI. In 2020, China’s rise as an FDI accomplice is especially noteworthy. In early 2020, Chinese language corporations negotiated and gained approval for main tasks regardless of tense relations between the 2 international locations. Japanese MNCs akin to Toyota, Honda, Canon, and Sumimoto have traditionally had a presence in Vietnam.

A brand new set of Japanese corporations akin to AEON, Uniqlo, and Mizuho have not too long ago expanded their presence within the Vietnamese market. A recent survey discovered that Japanese corporations rated Vietnam as probably the most promising FDI vacation spot in 2020. Equally, Thai firms registered twice as many tasks in 2020 than they did in 2019 attracted by the funding local weather and Vietnam’s participation in a number of regional commerce agreements.

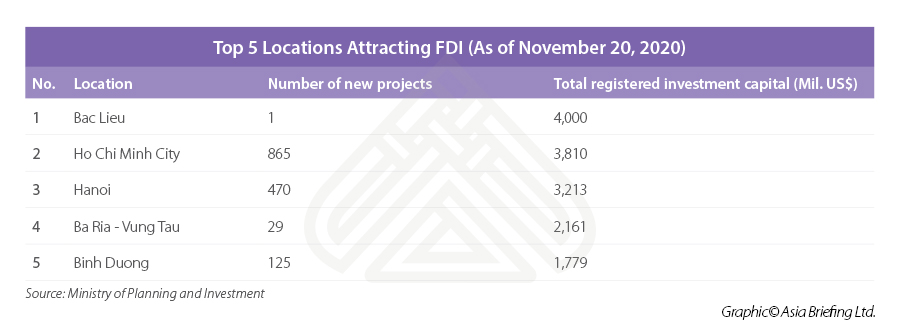

Bac Lieu province continued to be the biggest receipt of FDI as a result of a big liquified pure gas-fired energy plant undertaking value roughly US$4 billion. Nevertheless, Ho Chi Minh Metropolis got here second adopted by Hanoi taking the latter’s title.

Outlook for 2021

Whereas these tendencies are more likely to proceed into 2021, the yr forward might additionally result in structural shifts and modifications in funding patterns.

For instance, the rise of consumer-facing FDI is contingent on the expansion outlook for client spending and the return of mobility significantly in sectors akin to hospitality. As well as, Vietnam’s quickly evolving digital enterprise panorama might affect consumption tendencies.

By 2025, Vietnam’s digital economy might broaden to US$52 billion. Sub-sectors of the digital economic system akin to e-commerce, digital banking, and online gaming signify nascent and high-growth areas of client demand that traders might goal. Due to this fact, whereas the Vietnamese client stays a driver of FDI, it’s attainable that the routes international corporations have to take to succeed in the buyer might change.

The commerce depth of FDI can be more likely to broaden. Within the case of Japanese and Thai corporations, commerce agreements and entry to exterior markets is a high precedence for FDI individuals. Vietnam’s export and import industries each within the items and companies sectors might develop into profitable targets for traders. As well as, agreements with international locations past Asia might appeal to a new set of investors. For instance, analysis means that 72 % of EuroCham members are of the view that the EU-Vietnam FTA might result in a surge in European corporations investing in Vietnam.

For the yr forward, Vietnam stays a robust candidate for funding from ASEAN and past. Given its investor-friendly insurance policies, relative financial and political stability, price effectivity, and client demand prospects, Vietnam is more likely to proceed gaining from provide chains restructuring in Asia along with attracting a brand new vary of traders when it comes to geography and sectors.