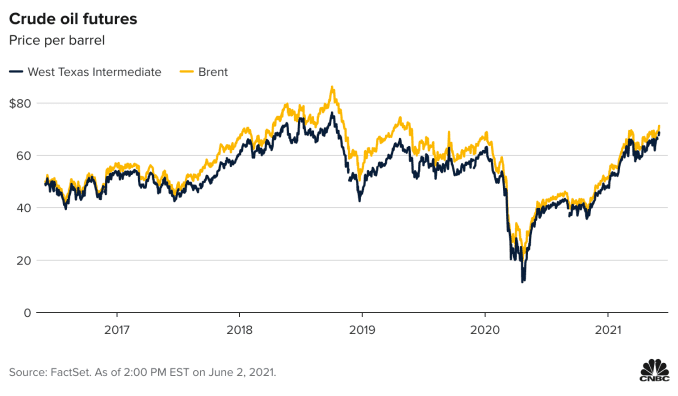

- Oil costs continued to rally Wednesday, and analysts anticipate costs to proceed to rise this summer season, presumably spiking to $80 per barrel or larger.

- The rise in costs comes because the demand outlook continues to strengthen. At a similar time, the world is now dipping into oil inventories constructed up the final 12 months.

- OPEC+ agreed to stay to its schedule to boost output, however, a wild card for the worldwide vitality image stays U.S. producers.

Oil costs might briefly spike to $80 per barrel or extra this summer season as demand comes roaring again.

The reopening economic system has already despatched crude up about 40% because the beginning of the 12 months, however a surge in driving by Individuals, in addition to a rise in items transportation and air journey, might strain costs additional.

For customers, meaning the standard early summer season peak in gasoline costs might come later within the season. Unleaded gasoline was $3.04 per gallon on common Wednesday, a few penny larger than final week however greater than 50% larger than a 12 months in the past, in keeping with AAA.

Brent futures, the worldwide crude benchmark, settled up 1.6% at $71.48 per barrel Wednesday, the very best since Jan. 8, 2020. West Texas Intermediate futures for July have been 1.6% larger at $68.83 per barrel, after hitting a excessive of $69.65, the very best since Oct. 23, 2018.

“Demand is ramping up in a short time as a result of all people’s driving, and we’ve the reopening of Europe, which is absolutely beginning to occur,” mentioned Francisco Blanch, international commodities and derivatives strategist at Financial institution of America. “India appears to have hit an inflection level, when it comes to circumstances, which in my thoughts might imply you additionally get a return of mobility.”

Uncertainty round larger costs

Power analysts agree the world is in for a interval of upper costs, however they don’t agree how excessive or for a way lengthy. Blanch mentioned Brent has already hit his $70 goal for the quarter, however he has a way more bullish longer-term view than others.

“We predict within the subsequent three years we might see $100 barrels once more, and we stand by that. That might be a 2022, 2023 story,” Blanch mentioned. “A part of it’s the reality we’ve OPEC sort of holding all of the playing cards, and the market is just not notably value responsive on the provision facet and there’s a lot of pent-up demand … We even have plenty of inflation in all places. Oil has been lagging the rise in costs throughout the economic system.”

Members of OPEC and their allies, a bunch generally known as OPEC+, are regularly returning oil to the market. They agreed to implement their beforehand deliberate manufacturing improve of 350,000 barrels a day in June and one other 450,000 barrels a day beginning in July. Saudi Arabia additionally agreed to step back from its own cuts of about a million barrels a day, which was put in place earlier within the 12 months.

OPEC+ had agreed in April to extend output by greater than 2 million barrels a day by the tip of July.

The U.S. trade is producing about 11 million barrels a day, down from about 13 million earlier than the pandemic. However analysts say it’s not clear how briskly or whether or not U.S. corporations will restore that manufacturing.

“The sensitivity of producers to cost adjustments has declined due to capital self-discipline,” mentioned Blanch. He mentioned there’s strain on corporations to be cautious in how they use capital after the collapse in costs final 12 months.

“Proper now we’re ready the place costs are rising, corporations are reluctant to take a position,” Blanch mentioned. “They’re paying down debt and rising dividends.”

He mentioned there’s additionally strain on company boards to divest hydrocarbon property and to work towards web zero on carbon emissions by 2050. “You’ve two main forces hampering capex within the vitality sector proper now,” Blanch mentioned.

Rising demand amid the restoration

For now, oil manufacturing has not stored up with demand, as international economies rebound. Even after OPEC+ dedicated Tuesday to return crude to the market, the worth of oil continued to tick up.

“Welcome to the post-pandemic world,” mentioned Daniel Yergin, vice chairman of IHS Markit. “We’re seeing demand is rising quickly between the primary quarter and the third quarter by 7 million barrels a day.”

Yergin mentioned his Brent goal is a mean $70 per barrel this 12 months.

“There’s an unimaginable case the place the oil value might get to $80, however there can be a response to that. That might begin to have an effect on demand, and in addition there can be a political response to that,” mentioned Yergin. “You’ll begin to see cellphone calls being made. [President Joe] Biden has been in politics lengthy sufficient to know that prime gasoline costs are all the time an issue for whoever is president. That’s true even in eras of vitality transitions.”

There’s a lot demand progress that analysts anticipate the market to have the ability to soak up a further million barrels a day of Iranian manufacturing ought to it return to its earlier commitments on its nuclear program, as sought by the Biden administration. However when which may occur is unsure.

“The return of Iranian barrels doesn’t seem like an imminent subject for the oil market with the fifth spherical of nuclear negotiations in Vienna failing to provide a serious diplomatic breakthrough,” wrote Helima Croft, head of worldwide commodity technique at RBC.

Croft added thatInternational Atomic Power Company verification of Iranian enrichment actions seems to be one of many points that have to be resolved earlier than sanctions aid can be offered by the Biden administration.

“With the Iranian election season in full swing, it now seems just like the return of these sanctions restricted barrels will doubtless be a summer season dialogue merchandise for OPEC,” she famous.

Croft mentioned it is usually vital who turns into the vitality minister for Iran following the election. The present minister has supported an orderly return to the oil market.

“How they return shall be vital and we’re intently watching what’s going to occur with their floating storage which has been rising,” she mentioned. Croft mentioned if Iran’s oil is just not restored in a gentle approach, it might spook the market and briefly ship costs decrease. The market will react “if it’s a shock and awe present based mostly on them dumping all their floating storage.”

Individually, Iran’s largest naval ship the Kharg sank on Wednesday after catching hearth within the Gulf of Oman. The crew have been reported protected, and no different explanations got for the incident, in keeping with Iran media.

Bullish demand and value forecasts have supported the acquire in crude costs this week, in keeping with John Kilduff of Once more Capital. He mentioned OPEC predicted that demand might attain 99.8 million barrels a day by the tip of the 12 months, however provide is predicted to succeed in simply 97.5 million barrels a day.

“I’ve been bullish for awhile now,” mentioned Kilduff. He expects to see Brent hit $80 a barrel and WTI commerce between $75 and $80. “The demand developments have been exploding … The true throes of this I think about will come as we get nearer to Labor Day.”

Kilduff mentioned the important thing to the longer-term view is how a lot the U.S. shale trade resumes its former actions and pushes forward.

Citigroup analyst Eric Lee mentioned he expects U.S. drillers to return to their prior ranges of manufacturing in the end, however he does word a change in perspective.

“When you break up them up, the non-public corporations have been responding rapidly. The general public independents and the majors have been much more cautious,” Lee mentioned.

OPEC + doesn’t at present see a menace from the U.S., and it has loads of spare manufacturing capability to curb larger costs and add provide if it wanted to. Beforehand, larger costs can be an invite for the U.S. shale trade to pump extra, which might in flip drive costs down.

“They’re not seeing U.S. producers coming again very strongly in the meanwhile, and I believe they’re of the view that U.S. producers gained’t come again robust,” he mentioned. “By way of how they’re behaving now, they’re not so nervous about shale proper now so that they’re extra prepared to carry again manufacturing.”